Start moving in the

right direction.

Speak to us today to see how we can improve your business logistics, freight and customs related issues.

Extending the GST to online overseas purchases of $1,000 or less would be an expensive and damaging mistake, according to new research released by free market think tank the Institute of Public Affairs.

A new report, No to the GST attack: Why the exemption for online purchases must stay, argues that putting a GST on low-value imports will not help Australian retailing, and will only succeed in making Australians pay more when shopping online.

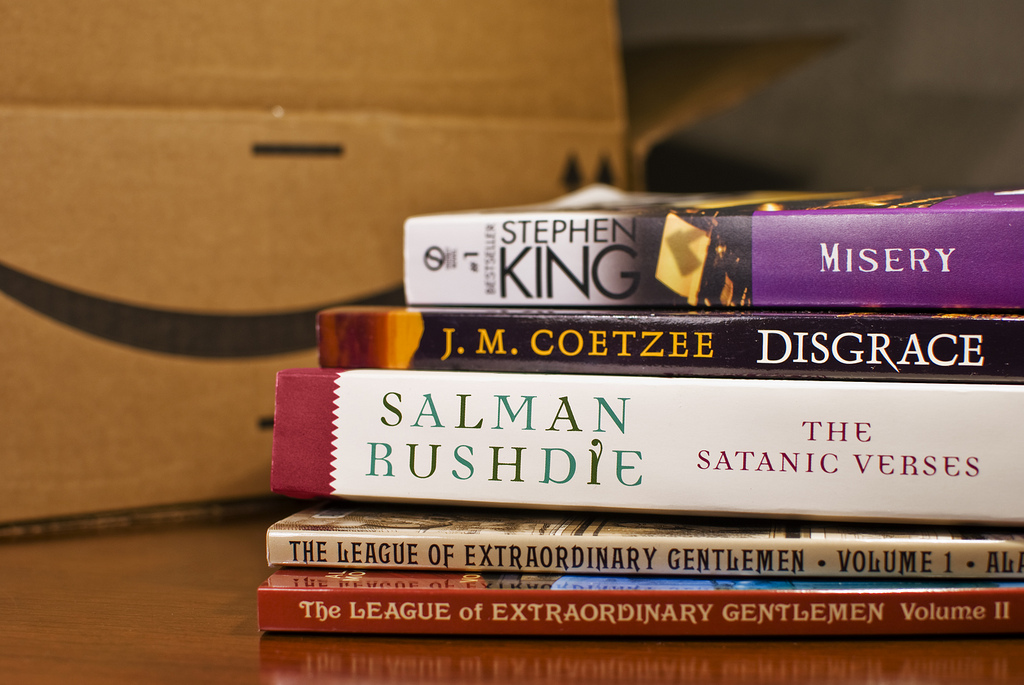

“The government should rule out this anti-consumer and protectionist proposal,” says Dr Mikayla Novak, Senior Research Fellow at the Institute of Public Affairs and the author of the report. “This proposal will do nothing to limit the advantages of internet shopping. It would still be cheaper to buy low value products from overseas retailers online than local retail outlets in store, even if the GST exemption is revoked. For example, a copy of the novel Gone Girl is available for $25.98 at Dymocks or $13.94 from online overseas retailer bookdepository.com. If the GST was applied to this, the cost from bookdepository.com would only rise to $15.33, still leaving it 41 per cent cheaper than buying from Dymocks.

The tax would also be so hard to collect that the costs of extending of GST would exceed the revenues collected. The Productivity Commission found that reducing the GST low-value threshold down to $100 would have raised $495 million for the government in 2010-11, but it also would have cost the government $1.2 billion to collect it.

The only thing extending the GST will achieve is increasing the cost of living for Australians, for no good reason,” says Dr Novak. The report also argues that the true path to reviving the Australian retail industry is to liberalise the regulations that contribute to the high retail costs in Australia. These problems include a highly regulated labour market, severe land use restrictions and trading hour conditions. “If the government is serious about helping the Australian retail industry, it should liberalise it. There are many problems with the Australian retail industry. The answer to those problems is certainly not removing the GST exemption on low-value imports,” says Dr Novak.

Photo by |Chris|

Photo by |Chris|

Established in 1917, Clarke Global Logistics is a reputable Australian Customs Broker and Freight Forwarder; offering a totally integrated trade service both locally and globally.

Speak to us today to see how we can improve your business logistics, freight and customs related issues.